Every year it is possible to assert that the upcoming budget presents a unique set of challenges for the Minister for Finance and the Minister for Public Expenditure and Reform.

However, that assertion can be made with solid conviction as we face into Budget 2023 next week.

COVID-19 has had a dramatic impact on the global economic and financial system since March 2020, but its very visible legacy has been compounded in dramatic fashion by the war in Ukraine. The global economic outlook is now deeply uncertain and very challenging; inflation has soared to the highest level in over three decades in the space of a few months; central bankers are moving aggressively to tighten interest rates; and we are facing into a very uncertain winter on the energy front.

Inflation is the biggest global economic story at the moment. Central bankers have recently adopted a stance of doing whatever they believe they now need to in order to prevent inflation from becoming embedded. They are clearly prepared to tolerate recession if that is what is required in the difficult battle to bring inflation under control. Global growth is now clearly vulnerable and the possibility of recession in the Euro Zone and the UK over the coming months looks high, while the US and China are also at distinct risk.

Interest Rates

The US Federal Reserve has increased interest rates 4 times since March, taking the rate up to a range of 2.25 per cent to 2.5 per cent. It will increase again this week. The Bank of England took its Base Rate to 1.75 per cent in August, and will tighten further shortly. In July, the European Central Bank (ECB) increased interest rates by 0.5 per cent, which was the first increase since 2011 and the largest since the early 2000s. It followed up with a rate increase of 0.75 per cent at the September meeting and is promising more to come despite the obvious risks to the Euro Zone economy. It seems clear that interest rates almost everywhere will be increased further over the coming months. It is not difficult to envisage the ECB’s key rate moving from 1.25 per cent at the moment to at least 2.5 per cent over the coming months.

To date the Irish economy has proven to be very resilient, but this cannot last, or at least that is what logic would suggest. Tax revenues are very strong; employment reached a new record high of 2.55 million at the end of June; the unemployment rate stood at 4.3 per cent of the labour force in August; and merchandise exports expanded by 27.6 per cent in the first seven months of the year. However, there is evidence of some softening in sentiment and real activity. Consumer confidence has fallen sharply over the past eight months; inflation is running at 8.7 per cent; and retail sales volumes fell by 6.3% in the May to July quarter compared to a year earlier. Consumer spending is coming under pressure from the cost-of-living escalation, but household savings stood at a record high of €144 billion in May. There is a COVID legacy here, but precautionary saving is now becoming apparent, which should not come as a surprise.

Tax Revenue

We can expect a very expansionary budget on 27th September 2022, and this will be made possible by the remarkable buoyancy displayed by tax revenues over the past eighteen months. In the year to the end of August, the Exchequer ran a surplus of €6.3 billion, which compares to a deficit of €6.7 billion in the same period in 2021. The turnaround of €13 billion is due to ongoing strong growth in tax revenues and reduced current expenditure as the COVID-19 supports are being phased out.

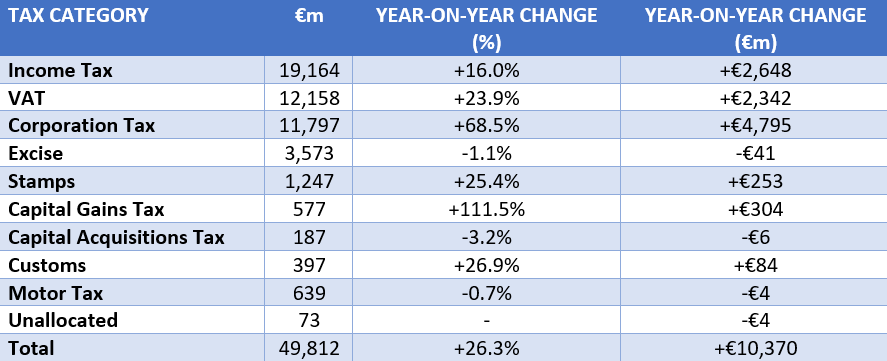

- Overall tax revenues totalled €49.8 billion, which is 26.3 per cent or €10.4 billion higher than the equivalent period in 2021.

- Corporation tax receipts in the first 8 months totalled €11.8 billion, which is €4.8 billion or 68.5 per cent higher than last year. While there are some timing issues here, it mainly reflects the strong profitability of many of the multi-nationals operating in Ireland. Corporation taxes accounted for 23.7 per cent of tax revenues in the first 8 months of the year. In the first 8 months of 2022, corporation tax was €6.9 billion or 139.4 per cent higher than the equivalent period in 2019.

- Income tax came in at €19.2 billion, which is 16 per cent or €2.6 billion ahead of 2021. The strength of income tax receipts reflects the very progressive nature of the Irish income tax system, and the high quality of employment that is being increasingly created in the economy. It is indicative of a very buoyant labour market, where retention, recruitment and increased labour costs are still significant challenges for many employers, despite the international head winds that are building steadily. Income tax accounted for 38.5 per cent of total tax revenues in the first 8 months of the year. In the first 8 months of 2022, income tax was €5.1 billion or 36.1 per cent higher than the equivalent period in 2019.

- VAT receipts totalled €12.2 billion, which is up 23.9 per cent or €2.3 billion on the same period in 2021. This reflects the ongoing improvement in consumer spending, although the year-on-year growth rate is exaggerated by the restrictions in place a year ago. However, when compared to the first 8 months of 2019, the VAT take is up by 22.8 per cent, or €2.2 billion.

Tax Revenues (Jan-Aug 2022)

The Role of Corporation Tax

Recent research from the Department of Finance points out that corporate tax receipts have more than doubled in just five years. As a result, the share of overall tax revenue accounted for by this revenue stream is now at historically high levels – close to €1 in every €4 of all tax collected is sourced from corporate tax payments. The Department is justifiably cautious that this significant shift in corporate tax receipts, occurring over a very short timeframe, raises legitimate questions regarding the sustainability of this revenue steam. In addition, the concentration of receipts within a small number of firms is an additional vulnerability – the latest data show that over half of corporate tax receipts is paid by just ten large payers.

The Department used a range of methodologies to assess the vulnerability of corporation tax receipts and concluded that the quantum of 2021 corporation tax receipts that are potentially at risk could be in the region of €4 to €6 billion, though it admitted that it is not difficult to conceive a situation in which the figure could be in excess of this.

The Department of Finance is suggesting that the ring-fencing of ‘windfall’ corporation receipts would help to de-risk the public finances. To do this, it argues that there is a compelling case to treat a portion of corporation tax receipts as ‘windfall’ in nature. One option would be to use these transitory receipts to capitalise some forward-looking fund. Replenishing the Rainy Day Fund is one possibility – this fund was established in 2019 but subsequently liquidated during the pandemic. As well as enhancing economic and fiscal resilience, accumulating funds in such a vehicle would, if unused, help meet the substantial state pension costs and health implications of population ageing over the coming years.

Budget 2023

In summary, ahead of Budget 2023, the external background is challenging and very uncertain; interest rates are rising; and the outlook for the still-strong domestic economy is becoming increasingly uncertain.

It seems likely that a budgetary package of around €6.7 billion will be delivered, as outlined in the Summer Economic Statement in early July, but it could be higher. €1.05 billion is thought to be pencilled in for tax changes, with a focus on the widening of bands and allowances. There is some speculation that there may be some tax increases in areas such as PRSI, but this would be irresponsible in the current environment. Over €5.6 billion is likely to be allocated for expenditure increases. There will be a significant social protection package.

In addition to these changes in taxation and expenditure in 2023, there is likely to be a package of once-off measures of up to €3 billion to address the cost-of-living crisis. At least once-off measures will not become permanently embedded in expenditure, but it is a dangerous strategy to expand spending aggressively based on Corporation Tax buoyancy that may not persist.

However, the political realities are clear and Budget 2023 is set to be a very political and populist offering. The cost-of-living crisis; the rental market and childcare are likely to dominate the budget. However, it is essential that if households are going to be helped out in a significant way, then the SME sector should get particular attention.